Learn how the 52 Week $5 Challenge helps you save almost $7,000 in a year. Use smart money saving strategies, a saving money chart, and simple financial life hacks to reach your goals.

If you’re looking for a simple, realistic way to build your savings without feeling overwhelmed, the 52 Week $5 Challenge might be exactly what you need. This challenge is one of the most effective money saving methods for people who struggle to save consistently but want real results by the end of the year. Let’s break down how it works, why it’s so effective, and how to make it fit into your saving money budget.

What Is the 52 Week $5 Challenge?

The 52 Week $5 Challenge is a gradual savings challenge where you start small and increase your savings each week.

- Week 1: Save $5

- Week 2: Save $10

- Week 3: Save $15

- Continue increasing by $5 every week

By Week 52, you’ll save $260 for that week alone. Over the course of the year, this money saving plan helps you save a total of $6,890 almost $7,000! This challenge works so well because it trains your brain and budget to adapt slowly, making it one of the most realistic money saving techniques available.

Why This Money Saving Strategy Actually Works

Many people fail at saving because they try to do too much too fast. The 52 Week $5 Challenge flips that approach on its head.

Here’s why it’s such a powerful money saving strategy:

- You start with an amount that feels painless

- Your savings habit grows gradually

- Your spending awareness improves week by week

- You naturally begin cutting unnecessary expenses

It’s one of those financial life hacks that doesn’t require fancy tools or financial expertise just consistency.

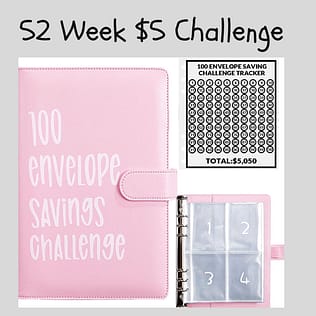

Use a Saving Money Chart to Stay on Track

To stay motivated, use a saving money chart or money chart that lists all 52 weeks and the amount you need to save each week. Checking off each week gives you a visual reminder of your progress and keeps you accountable. See Saving money chart on Amazon

You can:

- Print a savings chart

- Track it in a notebook

- Use a spreadsheet or budgeting app

Seeing your progress visually is one of the easiest money management advice tips for sticking with long-term goals.

How to Fit the Challenge Into Your Saving Money Budget

Worried that the later weeks will be too expensive? That’s completely normal. The key is planning ahead.

1. Create a Realistic Budget

A clear saving money budget shows you exactly where your money is going. Once your bills are covered, give your leftover money a purpose saving it intentionally.

2. Adjust Spending Habits Over Time

As the weeks go on, you’ll naturally start skipping unnecessary purchases. That daily coffee or random online shopping suddenly doesn’t feel worth it when you have a clear savings goal.

Increase Your Income to Make Saving Easier

One of the smartest money saving techniques isn’t just cutting expenses it’s earning more.

Consider:

- Picking up a side hustle

- Working overtime

- Selling unused items online

- Freelancing or offering services

Extra income can be dedicated entirely to your challenge, making the higher weekly amounts far less stressful.

Important Reminder Before You Start

This challenge is meant to help you, not hurt your finances. If at any point the weekly amount feels too high, it’s okay to pause, adjust, or modify the plan. The goal is progress, not perfection. Money saving challenges should support your financial health not create anxiety.

A Simple Plan With Big Results

The 52 Week $5 Challenge is one of the most beginner-friendly money saving strategies you can try. With a solid money saving plan, a clear saving money chart, and a realistic budget, saving nearly $7,000 in a year is absolutely possible. If you’re ready to take control of your finances, build better habits, and level up your savings, this challenge is a great place to start.

Happy saving! 💰